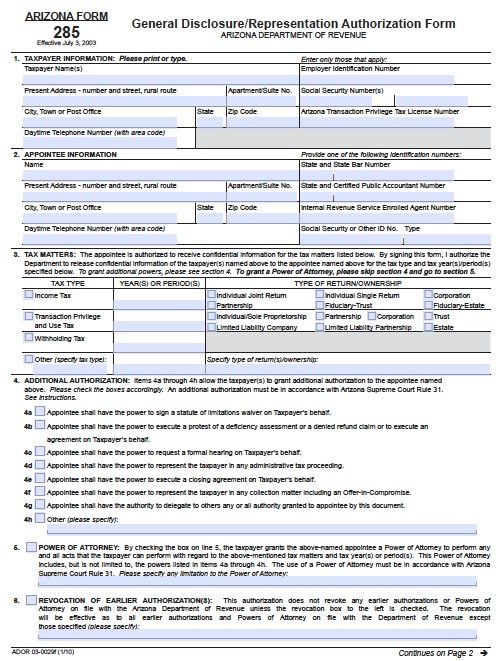

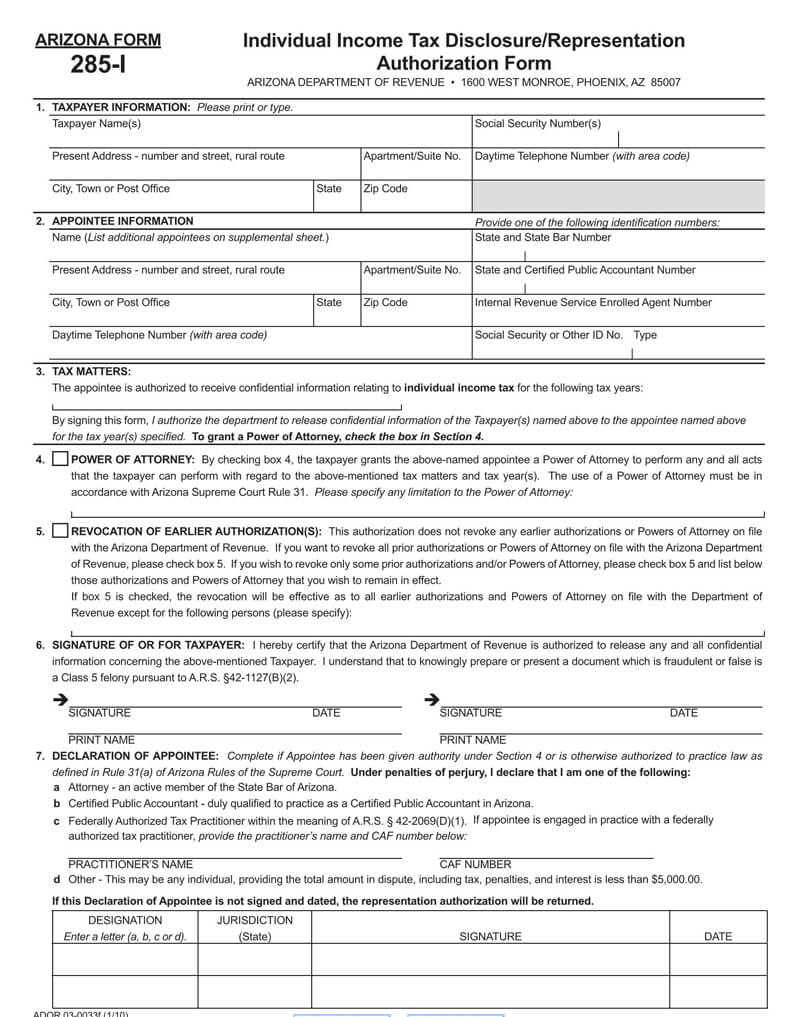

The arizona tax power of attorney form 285 can be used to elect a person usually an accountant to handle another person s tax filing within the state of arizona this document is the only poa form that does not need to have its signatures acknowledged before a notary public or witnessed.

Arizona power of attorney form 285.

This document is the only poa form that does not need to have its signatures acknowledged before a notary public or witnessed.

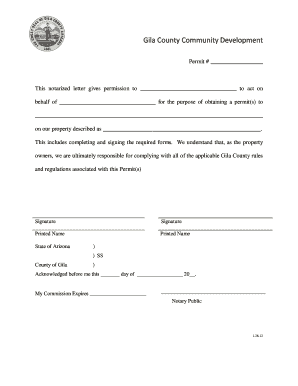

The files and forms are not intended to be used to engage in the unauthorized practice of law.

You may use the law library resource center power of attorney forms if.

Tax power of attorney arizona form 285 i adobe pdf use to elect a person most commonly an accountant to handle another person s tax filing with the state of arizona.

Users have permission to use the files forms and information for any lawful purpose.

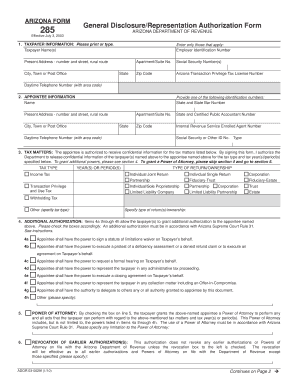

A taxpayer may also use form 285 to grant additional powers to the appointee up to and including a power of attorney.

42 2003 a 1 provides that confi dential information relating to a corporate taxpayer may be disclosed to a designee of the taxpayer who is authorized in writing by the taxpayer.

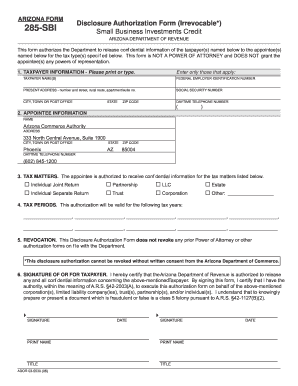

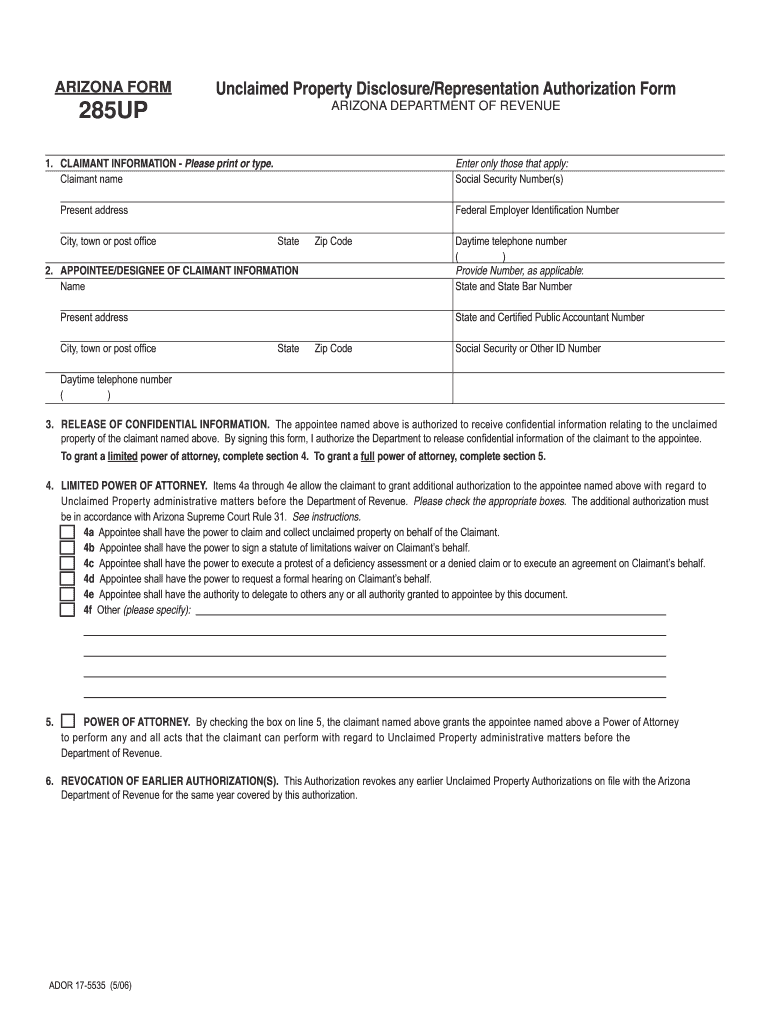

These forms authorize the department to release confidential information to the taxpayer s appointee.

Ador has revised the power of attorney and disclosure process for taxpayers to submit the necessary form.

The files included within the law library resource center s website are copyrighted.

Corporations having controlled subsidiaries.

This is the only power of attorney document that does not need to be notarized or witnessed by a third 3rd party.

Ador 03 0029f 1 10 az form 285 page 2 of 2 7.

Arizona tax power of attorney form 285 i allows a principal to give an agent specific tax related powers of attorney through the tax power of attorney document in the event that the principal finds him or herself unable to work with the state department of finance directly.

Typically this form will be attached to the tax filer s state income tax return sent to the.

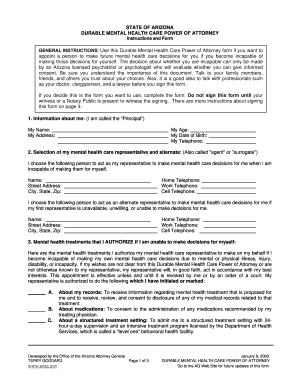

Power of attorney forms.

A taxpayer may now submit the arizona form 285 and form 285b through email or fax in addition to the mail.

You are 18 years of age or older and you live in arizona and you are of sound mind.

The arizona tax power of attorney form 285 can be used to elect a person usually an accountant to handle another person s tax filing within the state of arizona.

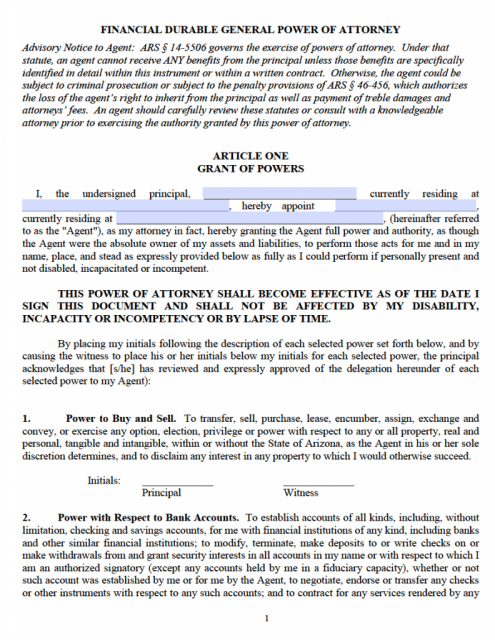

A power of attorney is a legal document which you can use to give another adult the authority to act on your behalf.